Importers around the world have been pleased to see the decrease in freight costs through 2022 from the COVID highs, but there's a new balancing act that the shipping industry is going to have to play - managing an influx of new ships just as demand drops off.

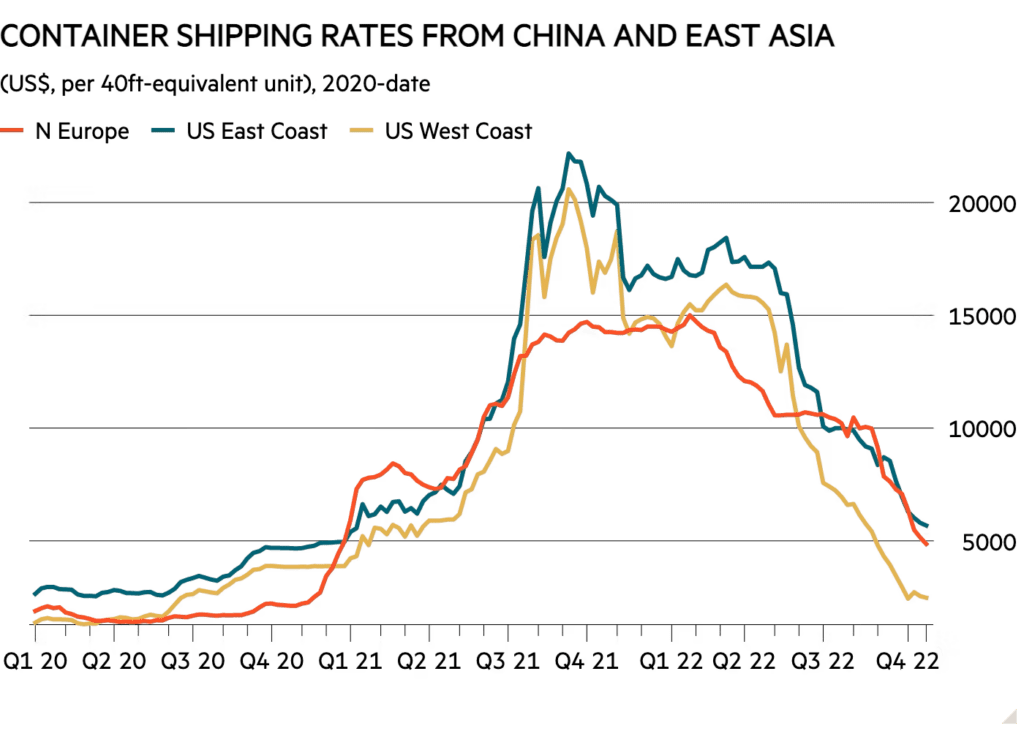

The numbers don't lie - shipping a 40ft container to Europe has dropped by two-thirds year-to-date to $4,861. This is, however, still around three and-a-half times higher than pre-pandemic levels. Even more drastic, the Freightos Baltic Index tells us that freight from China to the US West Coast has dropped by 84 per cent since the start of April to $2,470!

Port congestion issues are also on the decline, with just under 14 per cent of the global container shipping fleet by capacity stuck outside ports in January 2022, according to shipping data firm Xeneta.

This is all excellent news for importers and manufacturers alike, but let's take a look at the economic situation and how things have changed post-pandemic.

The forecast for Hapag Lloyd (DE:HLAG) is for Ebit growth of 83 per cent this year to €17.2bn (£14.8bn), while the world’s most profitable line, Maersk (DK:MAERSK.B), is forecasting earnings before interest and tax of $31bn this year, a 57 per cent increase on the $19.7bn earned last year.

These are massive unexpected profits and shipping lines have gone on a buying spree, ordering many new vessels. Drewery report a 34 per cent expected year-on-year increase on new vessel delivery for 2023, but all this is in stark contrast with forecast on demand grow sitting at a meagre 1.9 per cent. A lot of this is the shipping lines taking the windfall opportunity to upgrade their fleets to newer, more fuel efficient vessels.

The situation is likely to be exacerbated by the influx of new market entrants keen on getting in on the shipping boom (though likely to be a bit behind the curve at this point), and many market commentators are expecting the big container lines to pull a number of levers to limit supply growth and keep profits looking good.

It's going to be important to keep your ear to the ground (or water) in the coming months in order to get the best deals on freight, with a few watchdogs calling out the big shipping lines of - in simple language - price fixing, with the USA especially pushing back on anti-trust exemptions that are afforded shipping lines, but weren't set up to handle the extreme variation in market that COVID brought about.

Shipping lines took full advantage of post-pandemic shortages by hiking surcharges, but clogging of supply chains were due at least in part to a lack of resilience in inland infrastructure in the many places around the world, which couldn’t cope with fairly modest increases in demand for goods.

Basically, shipping lines are going to be trying to keep their profits up in this post-pandemic environment, which is to be expected. What we need to do as importers, exporters and traders in general, is shop around, giving the smaller players a chance to quote on freight and getting re-quotes closer to shipping dates.

It's going to be interesting to see the balance shift as freight supply outstrips demand in the coming years, but no doubt the equilibrium will be reached soon enough that all parties can stomach.

Reach out to us with details including your location and goods or services you’re after, and we’ll get back to you as soon as possible.

©Norico Ltd, 2022